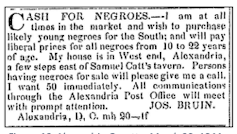

For my recently published book, “The Ledger and the Chain,” I visited more than 30 archives in over a dozen states, from Louisiana to Connecticut. Along the way, I uncovered mountains of material that exposed the depravity of the men who ran the largest domestic slave trading operation in American history and revealed the fortitude of the enslaved people they trafficked as merchandise.

But I also learned that many Americans do not realize that a domestic slave trade existed in the U.S. at all.

Mentioning my research to others repeatedly provoked questions about Africa, not America. They obviously assumed that a scholar working on the slave trade must be working on the trade that brought millions of Africans to the Western Hemisphere via the terrifying Atlantic Ocean crossing known as the Middle Passage.

They did not appear to know that by the time slavery ended in 1865, more than 1 million enslaved people had been forcibly moved across state lines in their own country, or that hundreds of thousands more had been bought and sold within individual states.