‘All Eyes Are Upon Us,’ by Jason Sokol - The New York Times

Race and politics from Boston to Brooklyn

reviewed by David Levering Lewis [biographer of W.E.B. DeBois]

If, as many believe, America’s experiment in postracialism is over, then “All Eyes Are Upon Us” is a prescient book that offers a great deal to explain a national self-deception of stunning brevity. According to Jason Sokol, whose anecdotally rich first book, “There Goes My Everything,” tracked white Southerners variously coping in the civil rights era, historians have paid insufficient attention to the Janus-faced responses of white Northerners to the struggles of black Americans. To be sure, monographs by James Goodman and Thomas Sugrue have explored the dark side of Northern race relations. They found that although the dominant racial philosophies of whites in the North and South were antithetical, opportunity for a majority of black men and women in the North was not very different from what it was in the South.

Friday, October 28, 2016

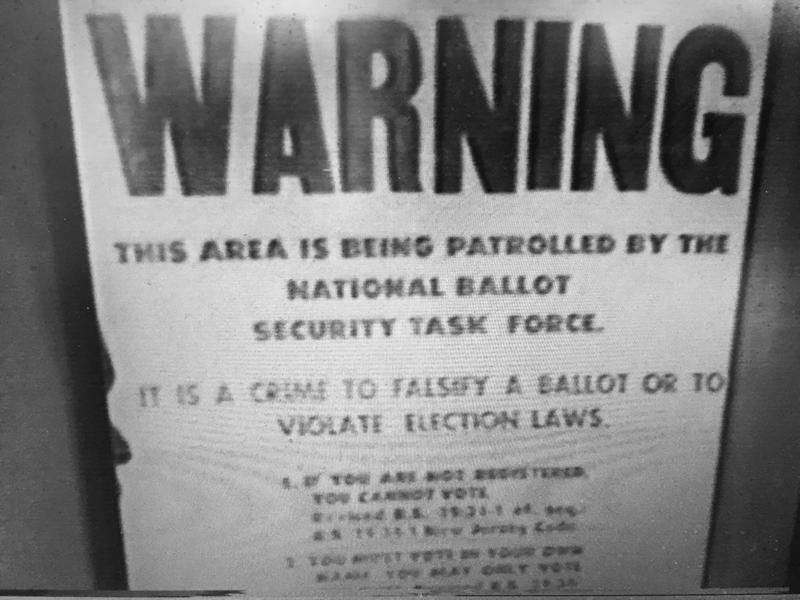

DNC moves to hold RNC in contempt of voter intimidation order

Roger Stone, a key pro-Trump operative got his start as a Nixon dirty trickster. He is up to new tricks. 'Vote for Hillary the new way, text 8888', he tweeted. That was the first exhibit in a motion by the Democratic National Committee which submitted a proposed Order to Show Cause. The DNC seeks an order holding the Republican National Committee in contempt of court and

In its brief the DNC seeks to extend for another eight years a 1982 consent decree later modified, extended and uphel in 2010 by the U.S. Court of Appeals in Philadelphia. Originally issued by the lae federal judge Dickinson Debevoise it bars the Republican Bational Committee from doing anything that has the purpose or effect of suppressing voter turnout. Further, the RNC is accused of violating its duty to obtain pre-clearance. The DNC brief asserts that "The 2009 Consent Decree provides that “[t]he RNC shall be required to notify the DNC and this Court of any proposed ballot security measures at least 10 days before instituting such measures so that this Court may determine their legality and whether they comply with the other terms of the Consent Decree.”"

The RNC has not yet filed answering papers. A key issue is whether the Tump campaign is an agent of the RNC - or vice versa. - gwc

(b) prohibiting Defendant RNC from allocating any money to fund, reimburse expenses for, or provide support for Donald J. Trump and/or his campaign’s voter intimidation program or his supporters’ plans to “watch” “certain sections” and “other communities”;

(c) directing Defendant RNC to seek reimbursement from the Trump campaign and all state political organizations for any funds previously allocated to fund any prohibited “ballot security” measures, including staff salaries, overhead expenses, training costs and expenses, digital resource expenditures, or any other resources used in any way to promote or facilitate the Trump campaign or state political organization “ballot security” or “integrity” endeavors;

(d) ordering Defendant RNC to distribute the Consent Decree and the relief awarded via this action to every RNC field office with instructions that no person employed by or affiliated with the RNC shall participate in any “ballot security” measures;

In its brief the DNC seeks to extend for another eight years a 1982 consent decree later modified, extended and uphel in 2010 by the U.S. Court of Appeals in Philadelphia. Originally issued by the lae federal judge Dickinson Debevoise it bars the Republican Bational Committee from doing anything that has the purpose or effect of suppressing voter turnout. Further, the RNC is accused of violating its duty to obtain pre-clearance. The DNC brief asserts that "The 2009 Consent Decree provides that “[t]he RNC shall be required to notify the DNC and this Court of any proposed ballot security measures at least 10 days before instituting such measures so that this Court may determine their legality and whether they comply with the other terms of the Consent Decree.”"

The RNC has not yet filed answering papers. A key issue is whether the Tump campaign is an agent of the RNC - or vice versa. - gwc

J&J, Talc Co. Hit With $70M Baby Powder Cancer Verdict - Law360

J&J, Talc Co. Hit With $70M Baby Powder Cancer Verdict - Law360

Law360, Los Angeles (October 27, 2016, 6:54 PM EDT) -- A Missouri jury slammed Johnson & Johnson and its talc supplier with a $70 million verdict late Thursday in a lawsuit filed by a woman who developed ovarian cancer after using J&J's baby powder on her genitals, the third massive verdict in that state's talc litigation.

Jurors in St. Louis found that plaintiff Deborah Giannecchini is owed $575,000 in economic damages and $2 million in non-economic compensatory damages. In addition, they said that J&J should pay $65 million in punitive damages, while talc supplier Imerys Talc America Inc. should pay $2.5 million.

The verdict falls far short of what Giannecchini had asked for -- more than $285 million total -- but is among the highest awarded in cases against J&J over the alleged link between talc and ovarian cancer. Another Missouri state jury awarded a plaintiff $72 million to another woman with the disease.

Shortly after the verdict was read, J&J announced it would mount an appeal.

During closing arguments earlier in the day, Giannecchini's attorney R. Allen Smith Jr. of The Smith Law Firm told jurors that the company callously joked about the possible cancer link and falsified medical records to hide it. He said the massive verdict is necessary to force "the largest corporation in the world" to change its ways, and that the company has rigged regulatory agencies in their favor.

"Make them stop," Smith said. "Stop this madness..."

KEEP READING

Law360, Los Angeles (October 27, 2016, 6:54 PM EDT) -- A Missouri jury slammed Johnson & Johnson and its talc supplier with a $70 million verdict late Thursday in a lawsuit filed by a woman who developed ovarian cancer after using J&J's baby powder on her genitals, the third massive verdict in that state's talc litigation.

The verdict is among the highest awarded in cases against J&J over the alleged link between talc and ovarian cancer. (AP)

The verdict falls far short of what Giannecchini had asked for -- more than $285 million total -- but is among the highest awarded in cases against J&J over the alleged link between talc and ovarian cancer. Another Missouri state jury awarded a plaintiff $72 million to another woman with the disease.

Shortly after the verdict was read, J&J announced it would mount an appeal.

During closing arguments earlier in the day, Giannecchini's attorney R. Allen Smith Jr. of The Smith Law Firm told jurors that the company callously joked about the possible cancer link and falsified medical records to hide it. He said the massive verdict is necessary to force "the largest corporation in the world" to change its ways, and that the company has rigged regulatory agencies in their favor.

"Make them stop," Smith said. "Stop this madness..."

KEEP READING

Tuesday, October 25, 2016

BREAKING: RJ Reynolds Hit With $29M Verdict In Smoking Death Trial - Law360

Doesn't happen often enough. - gwc

BREAKING: RJ Reynolds Hit With $29M Verdict In Smoking Death Trial - Law360

BREAKING: RJ Reynolds Hit With $29M Verdict In Smoking Death Trial - Law360

Law360, Los Angeles (October 25, 2016, 4:18 PM EDT) -- A Florida jury slammed R.J. Reynolds Tobacco Co. with $20 million in punitive damages Tuesday in a trial over the lung disease death of a sailor's chain-smoking wife, adding to an $8.8 million compensatory verdict awarded a day earlier and amounting to far more than the plaintiff requested.

Jurors awarded plaintiff, widower Alan Konzelman, about $10 million more than he had asked for. They gave him $8.8 million in compensatory damages for his own pain in suffering for losing his wife, Elaine Konzelman, when he had asked for $5 million plus nearly $300,000 to cover his late wife's medical expenses. During the punitive damages phase, he asked for $14 million but received $20 million.

During emotional closing arguments last week, Alan Konzelman's attorney Eric Rosen of Kelley/Uustal told jurors that sailor Alan Konzelman lost Elaine Konzelman, his wife of 29 years, to chronic obstructive pulmonary disease.

Rosen said that Alan loved her deeply, spent every spare moment with her and took her on adventures.

"They had an amazing and adventurous life that some people don't get to experience," he said. "They sailed, they got married, they had fun together and they grew old together. And they had a right to grow older together."

Jurors awarded plaintiff, widower Alan Konzelman, about $10 million more than he had asked for. They gave him $8.8 million in compensatory damages for his own pain in suffering for losing his wife, Elaine Konzelman, when he had asked for $5 million plus nearly $300,000 to cover his late wife's medical expenses. During the punitive damages phase, he asked for $14 million but received $20 million.

During emotional closing arguments last week, Alan Konzelman's attorney Eric Rosen of Kelley/Uustal told jurors that sailor Alan Konzelman lost Elaine Konzelman, his wife of 29 years, to chronic obstructive pulmonary disease.

Rosen said that Alan loved her deeply, spent every spare moment with her and took her on adventures.

"They had an amazing and adventurous life that some people don't get to experience," he said. "They sailed, they got married, they had fun together and they grew old together. And they had a right to grow older together."

Friday, October 21, 2016

Are Detroit’s Most Terrible Schools Unconstitutional? - The New York Times

Are Detroit’s Most Terrible Schools Unconstitutional? - The New York Times

by Geoffrey Stone

by Geoffrey Stone

At one Detroit school, just 4 percent of third graders scored proficient on Michigan’s English assessment test. At another, 9.5 percent did. Those students are among the plaintiffs in a lawsuit filed last month that asserts that children have a federal constitutional right to the opportunity to learn to read and write.

Illiteracy is the norm at those “slumlike” schools and others in Michigan’s biggest city, according to the plaintiffs. The facilities are decrepit and unsafe. The first thing some teachers do each morning is clean up rodent feces before their students arrive. In some cases, teachers buy the books and school supplies, even the toilet paper.

Lawyers for the students are arguing, in effect, that Michigan is denying their clients the right to a minimally adequate education, an issue that has been raised over the years in courts in other states under their state constitutions.

In Connecticut, a state judge last month ordered sweeping changes to reshape the state’s public schools after concluding that “Connecticut is defaulting on its constitutional duty” to provide all students with an adequate education. The judge concluded that the state’s funding system had “left rich school districts to flourish and poor school districts to flounder.”

Now the litigation in Detroit is raising this issue under the United States Constitution. The Supreme Court has never addressed whether disparities among schools would be constitutionally permissible if, as the court put it in 1973, a state failed “to provide each child with an opportunity to acquire the basic minimal skills necessary” for success in life....

Thursday, October 20, 2016

Trump's incoherent answer on Syria

http://www.vox.com/world/2016/10/19/13341882/donald-trump-third-debate-aleppo

Wednesday, October 19, 2016

Litigation Funders Planning a New Role: Law Firm Ownership | Law.com

Litigation Funders Planning a New Role: Law Firm Ownership | Law.com

by Roy Strom

by Roy Strom

Finance has a long history of creative expansion. Financing lawsuits is proving to be no exception.

Since litigation finance hit the scene just a couple decades ago, the business has evolved from investing in single lawsuits to groups of claims to purchasing judgments at bankruptcy auctions, as Chicago-based Gerchen Keller Capital did earlier this year.

Now, some litigation finance firms are preparing for an even bigger change to their business model: Injecting cash directly into law firms in the form of an equity stake that isn’t tied to any specific case. Litigation funders Burford Capital and Woodsford Litigation Funding told Law.com they intend to invest in U.K.-based firms that are allowed to have nonlawyer owners, something that remains against professional ethics in the United States.

“We’re open to that and excited about that,” Burford’s chief investment officer, Jonathan Molot, said regarding investing in firms known in the U.K. as “alternative business structures.”

Not everyone agrees.

There is a segment of the lawsuit finance industry that believes taking ownership in law firms could put litigation funders at odds with the lawyers they seek to work with. Others argue that better-capitalized law firms may cannibalize the need for more traditional funding of individual or groups of lawsuits before the industry matures. And equity investments in law firms would require a change from the “underwriting” method litigation funders currently use to analyze the likely results of potential cases.

“I don’t think you’ll have nonlawyers just handing money to law firm management and saying, ‘We trust you,’ ” said a litigation funding executive who declined to be named.

The discussion comes on the heels of Burford’s announcement this month that it had formed its own law firm under the U.K.’salternative business structures (ABS) law. The firm, Molot said, is limited to a lawyer who will track down funds from litigants who try to dodge judgments that Burford’s investments have helped to win. Burford hired Akin Gump Strauss Hauer & Feld counsel Tom Evans for the role, which it says represents “in-sourcing” an aspect of legal work that neither Burford nor the firms it funds typically specialize in.

Burford does not plan to hire lawyers to conduct its own case work, Molot said. The funder is wary to be seen as competing for legal work that it currently pays large law firms to handle, for fear of upsetting its relationships with those firms. Litigation funders typically rely on law firms to find many of the cases they ultimately invest in.

“That would never be our plan,” Molot said of creating a full-fledged ABS law firm.

For now, these concerns don’t affect law firms in the United States, where the American Bar Association still restricts nonlawyer ownership. The ABA asked for comments on potential rule changes in April, and Burford’s CEO, Christopher Bogart,responded in favor of expanding law firm ownership to nonlawyers. A change is not widely anticipated, and the ABA declined to expand ownership rules the last time it reviewed the subject, in 2011.

But there are plenty of U.S.-based litigation funders that do business in the U.K., and those financiers may see the opening of the country’s financial markets as an opportunity.

Tuesday, October 18, 2016

Contempt complaint against Sheriff Arapaio

Charges Against Sheriff Arpaio http://nyti.ms/2ec2TNu

Tuesday, October 11, 2016

Monday, October 10, 2016

Health Insurance From Invention to Innovation: A History of the Blue Cross and Blue Shield Companies

Health Insurance From Invention to Innovation: A History of the Blue Cross and Blue Shield Companies: The Blues invented health insurance. And we will continue to reinvent health insurance with the same spirit of innovation that has helped to improve the lives of generations of Americans. Now you can read about it as it happens, here at The Blue Cross and Blue Shield Blog.

NCAA Student-Athlete Concussion Injury Litigation

National Collegiate Athletic Association Student-Athlete Concussion Injury Litigation

Welcome to the NCAA Student-Athlete Concussion Injury Litigation Website

*If you are a medical provider wishing to provide services in the NCAA Medical Monitoring Program, the RFP and Provider Application can be found here.

If you played a National Collegiate Athletic Association (“NCAA”)-sanctioned sport at an NCAA member school, you may be entitled to free medical screening and may receive free medical testing, known as “medical monitoring,” up to two times over the next 50 years.

This website is designed to inform current and former NCAA Student Athletes of a settlement of a class action lawsuit titled In re National Collegiate Athletic Association Student-Athlete Concussion Litigation, Case No. 1:13-cv-09116, brought on behalf of current and former NCAA student-athletes and pending before Judge John Z. Lee of the United States District Court for the Northern District of Illinois.

The Court has granted preliminary approval of the Settlement and has set a final hearing to take place on May 5, 2017 at 10:00 am to determine if the Settlement is fair, reasonable and adequate, and to consider the request by Class Counsel for Attorneys’ Fees and Expenses and Service Awards for the Class Representatives.

You are a member of the Settlement Class (meaning you would be referred to as a "Settlement Class Member") if you played an NCAA-sanctioned sport at an NCAA school at any time prior to July 15, 2016. You do not need to have been diagnosed with a concussion to be a member of the Medical Monitoring Class.

If you are a Settlement Class Member, your legal rights and options are:

PROVIDE YOUR CONTACT INFORMATION BY CLICKING HERE TO RECEIVE INFORMATION REGARDING THE FREE MEDICAL MONITORING PROGRAM | If you think you might want to participate in the Medical Monitoring Program, you should send the Notice Administrator your contact information to be sure you receive further notice. If you do not do so, however, you will still have the right to participate later. The commencement of the Medical Monitoring Period will be announced on the Settlement Website and inquiries regarding the Medical Monitoring Program can be directed to the Notice Administrator by clicking here. |

COMMENT ON THE PROPOSED SETTLEMENT | Write to the Court about why you do, or do not, like the Settlement. Your comments or objections must be in writing and postmarked no later thanMarch 10, 2017. |

ATTEND THE FAIRNESS HEARING | Ask to speak in Court about the fairness of the Settlement. You may not speak unless have asked to do so in writing before March 10, 2017. |

EXCLUDE YOURSELF FROM THE SETTLEMENT CLASS | If you are a member of the Settlement Class but do not want to be bound by the proposed settlement, you must exclude yourself (“opt-out”) from the Settlement Class. If you exclude yourself, you will get no benefits. To ask to be excluded, you mail a written request stating that you want to be excluded. (Click here for further information about your right to exclude yourself from the Settlement Class.) |

DO NOTHING | Participation in the Medical Monitoring Program is completely voluntary. Final approval by the Court of the Settlement simply means that those eligible Settlement Class Members who wish to participate will have the opportunity to do so. If you do nothing now, you will have the right to participate in the Medical Monitoring Program in the future. |

Saturday, October 8, 2016

Is the N.F.L.’s Concussion Settlement Broken? - The New York Times

Dr. Robert Stern, Boston University center

for study of Ttrauumatic bain injury

has hope that ithin a decade CTE will be

diagnosable in living people,not just the dead at autopsy.

The short answer is Yes. The Supreme Court should take the case and hold that it is impermissible for a settlement to bar those whose causes of action have not yet accrued. Accrual means sufficient reason to believe that you have suffered both harm and a wrong that are causally related. - GWC

Is the N.F.L.’s Concussion Settlement Broken? - The New York Times

by Joe Nocera

...If we are, in fact, going to have the ability to diagnose the disease in living football players within the next decade, shouldn’t the N.F.L. and the plaintiffs’ lawyers want to use that diagnostic tool, whatever it turns out to be, to figure out who does and does not have C.T.E.? And wouldn’t they want to compensate football players who could show they had the actual disease that even the league acknowledges is related to head trauma?

Yet there is nothing in the settlement that offers that possibility. Twenty years from now — assuming Stern and others have succeeded in creating an accurate C.T.E. test — players with the diagnosis who exhibit the classic C.T.E. symptoms of anger, suicidal tendencies and so on will still get nothing from the settlement because they’ll have the “wrong” symptoms. Only when they get Alzheimer’s, which has nothing to do with football, will they be eligible for compensation.

I’ve listened to Seeger and others talk about how this was the best deal the players could have gotten, given the state of the science, the possibility of having the case thrown out of court, the lines in the sand the N.F.L. drew and so on. That’s all well and good. But if you’re going to settle lawsuits that are about a disease called C.T.E., wouldn’t you insist that the settlement have something to do with, well, C.T.E.? This one does not.

Wednesday, October 5, 2016

Talc Cancer Suits Consolidated in District of New Jersey // NJ Law Journal

Talc Cancer Suits Consolidated in District of New Jersey // NJ Law Journal

by Charles Toutant

by Charles Toutant

The U.S. Judicial Panel on Multidistrict Litigation has picked New Jersey as the site to consolidate suits nationwide linking cancer to usage of talcum powder.

The Oct. 4 order transferred 11 pending cases and 43 more potential actions from around the country to U.S. District Judge Freda Wolfson of the District of New Jersey. Wolfson presides over Chakalos v. Johnson & Johnson, which was filed in November 2014, making it the most advanced suit of its kind in the nation. Her experience with that case makes her well-situated to structure the litigation to minimize delay and avoid duplication of discovery and motion practice, the panel said. Furthermore, New Jersey is the best venue for the suits because it is home to Johnson & Johnson, a defendant in the litigation, so that relevant witnesses and evidence are likely located in the state, the panel said.

New Jersey was selected even though most plaintiffs who supported consolidation—those in nine cases—wanted the suits heard in the Southern District of Illinois, where two of the suits were filed. Plaintiffs in 12 cases opposed centralization. Johnson & Johnson and several other defendants proposed consolidation in the District of New Jersey or the Western District of Oklahoma.

The suits seek compensation for personal injuries or wrongful death that resulted from ovarian or uterine cancer in women who applied talcum powder to their genital area and for failure to warn of the risk of cancer. Some of the suits claim researchers have linked talc to cancer since the 1960s. The suits say manufacturers represented talcum powder as safe, failed to warn that it may cause cancer, and marketed the product to women with ads encouraging them to use such products to mask odors.

In addition to Johnson & Johnson, defendants include Sanofi US, Imerys Talc, Valeant Pharmaceuticals and Chattem. The plaintiffs used products such as Johnson & Johnson Baby Powder, Shower to Shower and Gold Bond. Shower to Shower was previously made by Johnson & Johnson but recently sold to Valeant; Gold Bond was made by Chattem, which was acquired by Sanofi in 2010. Imerys mined the talc in the products, plaintiffs claim.

Subscribe to:

Posts (Atom)